Difference between revisions of "Critical analysis: vbw-study "Folgen einer Lieferunterbrechung von russischem Gas für die deutsche Industrie" (June 2022)"

| (9 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | '''Executive summary:''' By shifting additional imports, storage injection and gas demand between months, the supply gap in the 2nd half of the year is artificially inflated, which explains higher economic effects compared to other studies. This monthly distribution contradicts available historical as well as current (2022) data, so it is very likely to be a deliberate manipulation. Populists like to seize on these questionable results to support their ''"Sanctions hurt us more than Putin"'' narrative. | ||

| + | |||

== Background == | == Background == | ||

| − | + | This study was carried out by [https://de.wikipedia.org/wiki/Prognos Prognos AG] and paid by [https://de.wikipedia.org/wiki/Vereinigung_der_Bayerischen_Wirtschaft vbw - Vereinigung der Bayerischen Wirtschaft e. V.]<ref> {{Citation | vauthors=vbw | year=2022 | title=Konsequenzen eines Importstopps von russischem Erdgas | url=https://www.vbw-bayern.de/Redaktion/Frei-zugaengliche-Medien/Abteilungen-GS/Wirtschaftspolitik/2022/Downloads/vbw_Studie_Folgen_Lieferunterbrechung_von_russischem_Erdgas_Juni_2022.pdf | access-date=28 June 2022}}</ref>. | |

| − | + | The main findings (12,7 % economic output reduction and 5.6 million "affected" jobs) are used as an argument that Russian gas supply stop would have "catastrophic" consequences for the German economy. However, those number were obtained based on unrealistic and/or outdated assumptions, which we will try to explain in the following. Furthermore, both numbers are prone to misinterpretation, which was already the case in the [[Iwh_embargo_study|IWH study]]. | |

| + | These results are interesting in that they contradict other analyses. For example, the latest joint diagnosis by five leading economic institutes, which also models supply freezes from July, concludes that there will be no gas shortage in 2022. This is true even for the worst-case scenario with the most pessimistic assumptions.<ref name="gd_juni">{{Citation | vauthors=Gemeinschaftsdiagnose | year=2022 | title=Zur Gefahr einer Gaslücke in Deutschland bei einem Wegfall russischer Lieferungen - Sonderauswertung Juni 2022 | url=https://gemeinschaftsdiagnose.de/wp-content/uploads/2022/06/gemeinschaftsdiagnose_sonderauswertung-gasluecke-juni-2022.pdf}}</ref> The authors explain this discrepancy by saying that "in this study, natural gas-intensive production processes are considered separately and in great detail" (p. 31). However, we show that larger gas gaps and correspondingly higher economic effects result primarily from a massive and implausible underestimation of replacement imports in the 2nd half of 2022, | ||

[[File:Vbw-study-table5.png|thumb|alt=]] | [[File:Vbw-study-table5.png|thumb|alt=]] | ||

[[File:Corrected table 5.png|thumb]] | [[File:Corrected table 5.png|thumb]] | ||

| − | == | + | == Our critical analysis == |

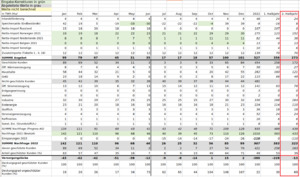

| + | Our main criticism is that the gas gap of 154 TWh (full year 2022) and 108 TWh (2nd half year) is largely overestimated. This happens due to wrong or implausible assumptions, as can be seen in Table 5 (page 44 of the study, see figure on the right). This Table 5 is used for the core results of the study (e.g. figure on page 24). In detail: | ||

| + | |||

| + | * '''Supply (Jul-Dec: 70 to 170 TWh missing)''' | ||

| + | ** The estimated storage filling amounts for July-Oct in Table 5 are too high (90 TWh), which explicitly contradicts the statement on p. 7: "To reach the Germany-wide fill level target of 90% by Nov 01, 2022, about 78 TWh (Hu) (Bavaria: 12 TWh) will still be needed (excluding Haidach)." Moreover, the storage level reached 61% (148 TWh) as of June 30, so the actual demand after July 1 will be even lower (~70 TWh). | ||

| + | ** There is an underestimation of imports from the Netherlands and Norway in the 2nd half of the year, which suddenly decrease in May/June in contrast to April, which contradicts the premises of the study (p.17, table 1, figure 1) as well as [https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/Versorgungssicherheit/aktuelle_gasversorgung/_downloads/07_Juli_2022/220704_gaslage.pdf?__blob=publicationFile&v=2#page=3 actual imports]. If the calculation method on p.17 is applied - i.e. the additional gas volumes of just under 140 TWh are distributed evenly over the months and added to the corresponding volumes supplied in the previous year - this results in just under 50 TWh more gas supply in the 2nd half of the year than is shown in Table 5. | ||

| + | ** However, non-Russian imports increased by 100 TWh in Q1 2022 alone compared to Q1 2021 (Fig. 1), and remain at the high level. This suggests that the additional supply of 140 TWh per year was too pessimistically estimated. For example, Norway delivered +80% more in Q1 instead of +10% (Fig. 1). If we assume that deliveries remain at similar levels in H2 as before, this results in a supply plus of 150 TWh compared to Table 5. | ||

| + | |||

| + | * '''Demand (Jul-Dec: overestimated by at least 6 TWh )''' | ||

| + | ** The total consumption (before savings) for 2022 is estimated at 938 TWh (or 935 TWh in table 5). This figure was supposedly taken from the year 2021 (p.18) and should come from AG Energiebilanzen, but cannot be found in the sources given. Instead, 1.012 TWh is given there <ref>https://ag-energiebilanzen.de/wp-content/uploads/2022/04/AGEB_Jahresbericht2021_20220524_dt_Web.pdf#page=20</ref>. This latter figure also roughly corresponds to the [[Energy_data|information from BDEW and BNetzA]] (1.016 TWh). | ||

| + | ** What is interesting here is a very atypical distribution over the months: although for the year as a whole the study reckons with a good 80 TWh '''less''' consumption than BDEW/BNetzA, in the second half of the year there are 6 TWh '''more'''. Especially in May, the consumption of 43 TWh is unrealistically low (on the level of the summer months, cf. BNetzA: 68.2 TWh, BDEW: >60 TWh). In contrast, consumption in Jul-Dec is almost always higher than indicated by BDEW/BNetzA (exception: Oct). | ||

| + | ** The already realized gas savings in Jan-Jun 2022 compared to 2021 are 89 TWh ([https://embargo.energy/index.php/Energy_data#Bundesnetzagentur -9% to -27% monthly, increasing trend]). This has been achieved despite the fact that the main savings measures have not yet been implemented. In Jan/Feb, for example, hardly any savings were made in heating, and in the 1st half of the year at least 60 TWh of natural gas were used to generate electricity in power plants. Therefore, the savings of 112 TWh in the 2nd half of the year, as calculated in the study, seem to us to be too pessimistic. | ||

| + | ** The savings calculated in table 2 as of July are apparently *not* included in table 5, but can only be read graphically in fig. 7. This unnecessarily complicates the analysis and correction of the results. | ||

| − | + | == Our correction == | |

| − | |||

| − | |||

| − | |||

| + | We correct the above inconsistencies in Table 5, considering two scenarios: | ||

| − | + | 1. '''Pessimistic'''. Here, the current developments in 2022 were largely ignored, and only the historical data from 2021 and assumptions made in the study were used for calculations. In this scenario, there is a gas gap of only 13 TWh in the second half of 2022, or an order of magnitude smaller than Prognos calculated (110 TWh). | |

| − | |||

| + | 2. '''Realistic'''. Here, it is assumed that the trends observed in H1 2022 regarding imports and savings continue in H2 2022. In this case, there would even be a supply surplus of almost 80 TWh in H2 2022. | ||

| − | + | A table corrected with regard to imports and storage is available at: https://files.embargo.energy/vbw-analysis/vbw-tabelle5_corrected_alex.xlsx | |

| − | == | + | == Media coverage of this study == |

| − | *{{ | + | *{{Citation | title=Deutschlands Wettbewerbsstärke: Forscher warnen vor Gaskrise – Speicher jetzt zu 60 Prozent gefüllt | url=https://www.faz.net/aktuell/wirtschaft/gaslieferungen-abhaengigkeit-gefaehrdet-deutschlands-wettbewerbsfaehigkeit-18133876.html | access-date=28 June 2022}} |

*https://www.spiegel.de/wirtschaft/unternehmen/russlands-gas-lieferstopp-verband-warnt-vor-wirtschaftseinbruch-um-12-7-prozent-a-cf67b579-8951-4706-9272-e60d71c03a23 | *https://www.spiegel.de/wirtschaft/unternehmen/russlands-gas-lieferstopp-verband-warnt-vor-wirtschaftseinbruch-um-12-7-prozent-a-cf67b579-8951-4706-9272-e60d71c03a23 | ||

*https://www.manager-magazin.de/politik/deutschland/gas-stopp-russischer-gaslieferungen-koennte-deutschland-rund-13-prozent-der-wirtschaftsleistung-kosten-a-0ae39890-5c4d-425a-abca-a567f1bd936b | *https://www.manager-magazin.de/politik/deutschland/gas-stopp-russischer-gaslieferungen-koennte-deutschland-rund-13-prozent-der-wirtschaftsleistung-kosten-a-0ae39890-5c4d-425a-abca-a567f1bd936b | ||

| − | *https://www.br.de/nachrichten/wirtschaft/gas-stopp-aus-russland-wuerde-laut-studie-wirtschaft-hart-treffen, | + | *https://www.br.de/nachrichten/wirtschaft/gas-stopp-aus-russland-wuerde-laut-studie-wirtschaft-hart-treffen,TA3Wggm |

| − | |||

| − | |||

== References == | == References == | ||

<references /> | <references /> | ||

Latest revision as of 16:27, 28 February 2023

Executive summary: By shifting additional imports, storage injection and gas demand between months, the supply gap in the 2nd half of the year is artificially inflated, which explains higher economic effects compared to other studies. This monthly distribution contradicts available historical as well as current (2022) data, so it is very likely to be a deliberate manipulation. Populists like to seize on these questionable results to support their "Sanctions hurt us more than Putin" narrative.

Background[edit | edit source]

This study was carried out by Prognos AG and paid by vbw - Vereinigung der Bayerischen Wirtschaft e. V.[1].

The main findings (12,7 % economic output reduction and 5.6 million "affected" jobs) are used as an argument that Russian gas supply stop would have "catastrophic" consequences for the German economy. However, those number were obtained based on unrealistic and/or outdated assumptions, which we will try to explain in the following. Furthermore, both numbers are prone to misinterpretation, which was already the case in the IWH study.

These results are interesting in that they contradict other analyses. For example, the latest joint diagnosis by five leading economic institutes, which also models supply freezes from July, concludes that there will be no gas shortage in 2022. This is true even for the worst-case scenario with the most pessimistic assumptions.[2] The authors explain this discrepancy by saying that "in this study, natural gas-intensive production processes are considered separately and in great detail" (p. 31). However, we show that larger gas gaps and correspondingly higher economic effects result primarily from a massive and implausible underestimation of replacement imports in the 2nd half of 2022,

Our critical analysis[edit | edit source]

Our main criticism is that the gas gap of 154 TWh (full year 2022) and 108 TWh (2nd half year) is largely overestimated. This happens due to wrong or implausible assumptions, as can be seen in Table 5 (page 44 of the study, see figure on the right). This Table 5 is used for the core results of the study (e.g. figure on page 24). In detail:

- Supply (Jul-Dec: 70 to 170 TWh missing)

- The estimated storage filling amounts for July-Oct in Table 5 are too high (90 TWh), which explicitly contradicts the statement on p. 7: "To reach the Germany-wide fill level target of 90% by Nov 01, 2022, about 78 TWh (Hu) (Bavaria: 12 TWh) will still be needed (excluding Haidach)." Moreover, the storage level reached 61% (148 TWh) as of June 30, so the actual demand after July 1 will be even lower (~70 TWh).

- There is an underestimation of imports from the Netherlands and Norway in the 2nd half of the year, which suddenly decrease in May/June in contrast to April, which contradicts the premises of the study (p.17, table 1, figure 1) as well as actual imports. If the calculation method on p.17 is applied - i.e. the additional gas volumes of just under 140 TWh are distributed evenly over the months and added to the corresponding volumes supplied in the previous year - this results in just under 50 TWh more gas supply in the 2nd half of the year than is shown in Table 5.

- However, non-Russian imports increased by 100 TWh in Q1 2022 alone compared to Q1 2021 (Fig. 1), and remain at the high level. This suggests that the additional supply of 140 TWh per year was too pessimistically estimated. For example, Norway delivered +80% more in Q1 instead of +10% (Fig. 1). If we assume that deliveries remain at similar levels in H2 as before, this results in a supply plus of 150 TWh compared to Table 5.

- Demand (Jul-Dec: overestimated by at least 6 TWh )

- The total consumption (before savings) for 2022 is estimated at 938 TWh (or 935 TWh in table 5). This figure was supposedly taken from the year 2021 (p.18) and should come from AG Energiebilanzen, but cannot be found in the sources given. Instead, 1.012 TWh is given there [3]. This latter figure also roughly corresponds to the information from BDEW and BNetzA (1.016 TWh).

- What is interesting here is a very atypical distribution over the months: although for the year as a whole the study reckons with a good 80 TWh less consumption than BDEW/BNetzA, in the second half of the year there are 6 TWh more. Especially in May, the consumption of 43 TWh is unrealistically low (on the level of the summer months, cf. BNetzA: 68.2 TWh, BDEW: >60 TWh). In contrast, consumption in Jul-Dec is almost always higher than indicated by BDEW/BNetzA (exception: Oct).

- The already realized gas savings in Jan-Jun 2022 compared to 2021 are 89 TWh (-9% to -27% monthly, increasing trend). This has been achieved despite the fact that the main savings measures have not yet been implemented. In Jan/Feb, for example, hardly any savings were made in heating, and in the 1st half of the year at least 60 TWh of natural gas were used to generate electricity in power plants. Therefore, the savings of 112 TWh in the 2nd half of the year, as calculated in the study, seem to us to be too pessimistic.

- The savings calculated in table 2 as of July are apparently *not* included in table 5, but can only be read graphically in fig. 7. This unnecessarily complicates the analysis and correction of the results.

Our correction[edit | edit source]

We correct the above inconsistencies in Table 5, considering two scenarios:

1. Pessimistic. Here, the current developments in 2022 were largely ignored, and only the historical data from 2021 and assumptions made in the study were used for calculations. In this scenario, there is a gas gap of only 13 TWh in the second half of 2022, or an order of magnitude smaller than Prognos calculated (110 TWh).

2. Realistic. Here, it is assumed that the trends observed in H1 2022 regarding imports and savings continue in H2 2022. In this case, there would even be a supply surplus of almost 80 TWh in H2 2022.

A table corrected with regard to imports and storage is available at: https://files.embargo.energy/vbw-analysis/vbw-tabelle5_corrected_alex.xlsx

Media coverage of this study[edit | edit source]

- Deutschlands Wettbewerbsstärke: Forscher warnen vor Gaskrise – Speicher jetzt zu 60 Prozent gefüllt, retrieved 28 June 2022

- https://www.spiegel.de/wirtschaft/unternehmen/russlands-gas-lieferstopp-verband-warnt-vor-wirtschaftseinbruch-um-12-7-prozent-a-cf67b579-8951-4706-9272-e60d71c03a23

- https://www.manager-magazin.de/politik/deutschland/gas-stopp-russischer-gaslieferungen-koennte-deutschland-rund-13-prozent-der-wirtschaftsleistung-kosten-a-0ae39890-5c4d-425a-abca-a567f1bd936b

- https://www.br.de/nachrichten/wirtschaft/gas-stopp-aus-russland-wuerde-laut-studie-wirtschaft-hart-treffen,TA3Wggm

References[edit | edit source]

- ↑ vbw (2022), Konsequenzen eines Importstopps von russischem Erdgas (PDF), retrieved 28 June 2022

- ↑ Gemeinschaftsdiagnose (2022), Zur Gefahr einer Gaslücke in Deutschland bei einem Wegfall russischer Lieferungen - Sonderauswertung Juni 2022 (PDF)

- ↑ https://ag-energiebilanzen.de/wp-content/uploads/2022/04/AGEB_Jahresbericht2021_20220524_dt_Web.pdf#page=20